Cover image via

A key congressional leader is pushing to add social equity provisions for low-income and minority cannabis business owners into the 2023 Farm Bill.

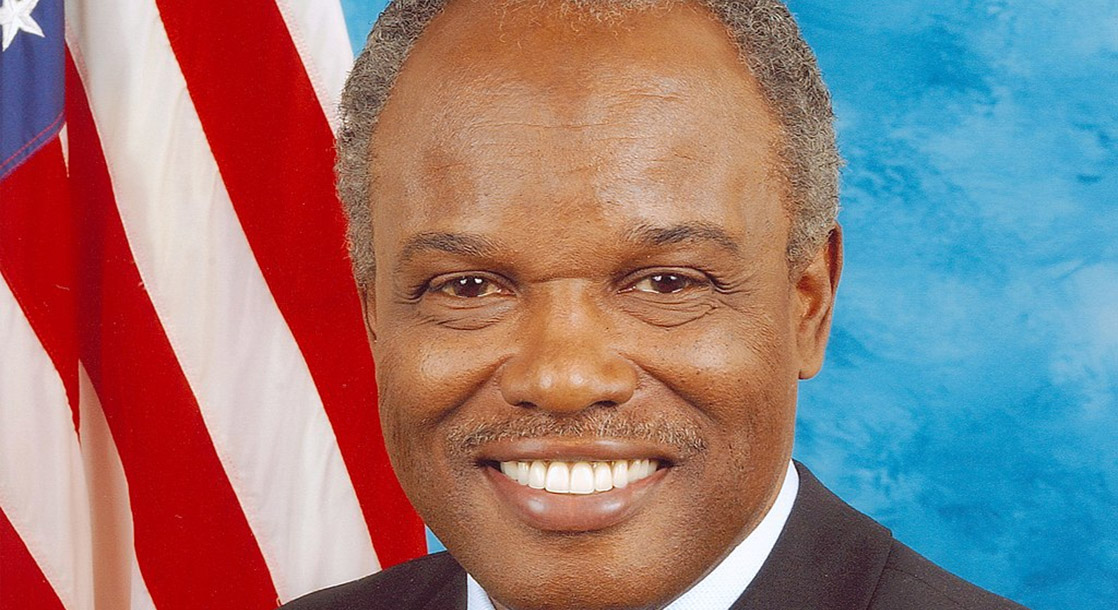

House Agriculture Chairman David Scott (D-GA) acknowledged the issues that minority-owned cannabis businesses face during a recent financial committee meeting. At the meeting, Amber Littlejohn, executive director of the Minority Cannabis Business Association, described how federal banking restrictions, excessive licensing and regulatory fees, and underfunded state social equity programs make it extremely difficult for small businesses to compete with wealthy, white-owned cannabis firms.

Out of 37 states that have legalized medical or adult-use cannabis, only 15 have set up state-sponsored social equity programs, Littlejohn explained. And many of these programs have failed to meet their goals, largely because they do not receive enough funding to help cover the high costs of starting a legal cannabis business.

“What we’ve seen is they’re rolling out these equity programs, but the funding is not there,” Littlejohn said, according to Roll Call. “There is a clock ticking on the amount of time that people have to get their businesses up and running.”

In Scott’s home state of Georgia, for example, applicants hoping to start a legal medical marijuana cultivation or processing company need to cough up a $200,000 application fee. Only four Black-owned businesses managed to raise enough money to pay these fees, and the state rejected all of them. In literally any other industry, an entrepreneur with a solid business plan could get a startup loan from a bank, but federal law prevents banks from working with cannabis businesses.

“This exclusion has added insult to injury,” said Rep. Ayanna S. Pressley (D-MA), Roll Call reports. “Ensuring Black and brown folks can start and sustain cannabis businesses is a matter of economic and racial justice.”

“Not only must these businesses contend with the ongoing pandemic and other economic uncertainties without being eligible for any federal small business aid, but they must do so while being shut out of the banking system,” Subcommittee Chairman Ed Perlmutter (D-CO) added. “Forcing this industry to do business in all-cash is turning into a public safety nightmare.”

In an attempt to remove these banking barriers, Perlmutter drafted the SAFE Banking Act, a bill that would block the feds from penalizing financial institutions that want to work with weed businesses. The House has passed this bill on six separate occasions now, but the Senate killed it each time. Sen. Majority Leader Chuck Schumer (D-NY) has argued that Congress should instead resolve the problem by ending federal cannabis prohibition entirely, but recently suggested that he would consider the banking bill if it included additional social equity provisions.

While Perlmutter continues to fight for the SAFE Banking Act, Scott suggested that Congress should further address the issue by adding social equity provisions to the 2023 Farm Bill. Out of hundreds of cannabis reform bills and amendments brought before Congress in the past five years, the only major change to federal cannabis law was introduced via the 2018 Farm Bill. This agricultural bill fully legalized the cultivation, processing, and sale of industrial hemp and hemp-derived cannabinoids.

Based on the success of this law, Scott is hoping that the next farm bill could be the ideal outlet for reforming the country’s restrictions against high-THC cannabis as well as hemp.

“Here we are, the fastest growing agricultural product, between hemp and cannabis,” Scott said at the meeting, Roll Call reports. “We’re also going into our farm bill. We’ve got to address this issue. We can no longer hide it.”