New Jersey lawmakers have just advanced a unique bill that would require state insurance providers to cover the costs of medical cannabis for any registered patient.

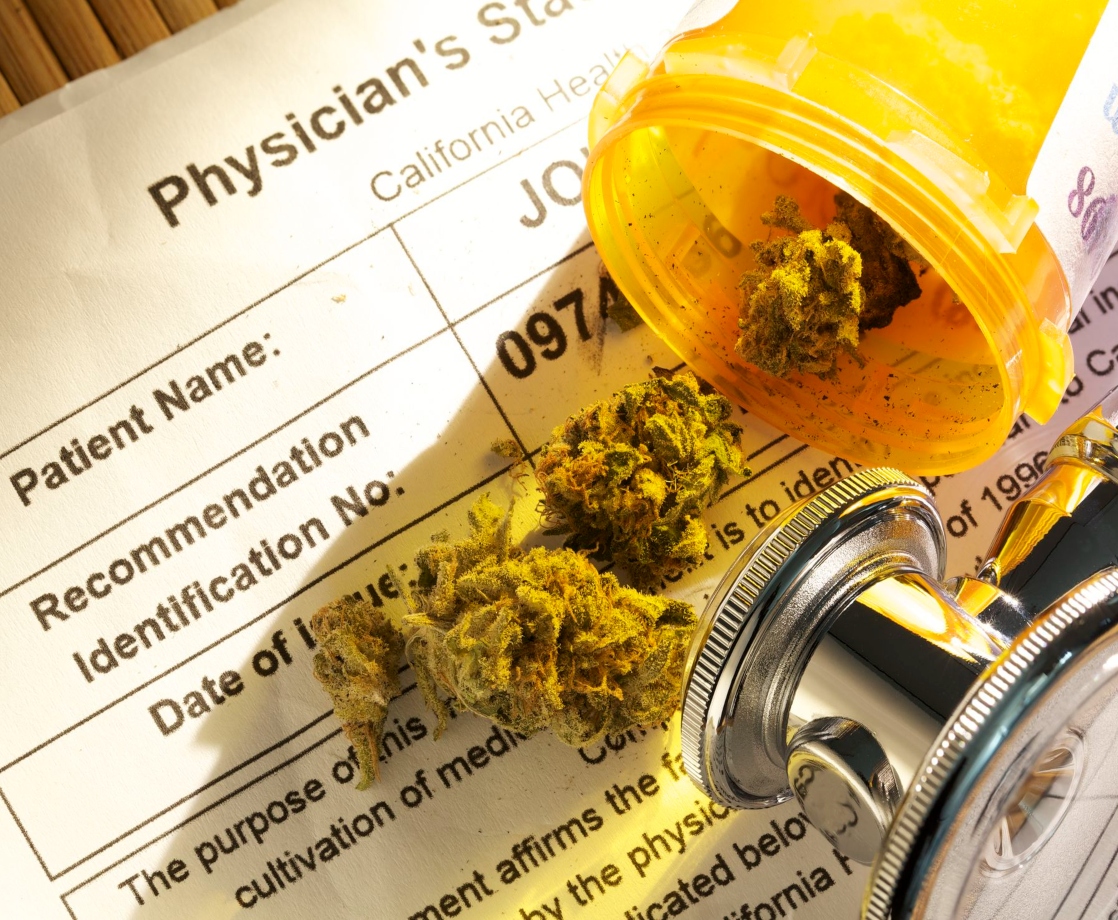

Medical marijuana is currently legal in 33 US states, yet insurance providers continue to use the federal prohibition of cannabis as an excuse to avoid covering costs associated with this medicine. As a result, most patients registered with state-legal medical marijuana programs have to shoulder the full cost of medical pot on their own.

New Jersey Assemblymembers John Burzichelli (D), Herb Conaway (D), and Joann Downey (D) have just proposed a new bill (A1708) that would require workers’ compensation and personal injury protection (PIP) auto insurance companies to provide medical marijuana benefits under specific circumstances. The state Assembly Appropriations Committee just advanced the bill with a 7-4 vote, but it still needs to be approved by the state Assembly, Senate, and governor to become law.

“Many workers’ compensation insurance companies and PIPs are still hesitant to cover medical cannabis or have an outright policy of denying it,” the bill’s sponsors said in a joint statement reported by Marijuana Moment. “People injured and receiving coverage through PIP or worker’s comp can come away from a doctor’s appointment with a prescription for medical marijuana; however, it is not definite that their healthcare plan will cover it or reimburse them for the costs.”

“The dispensing of medical cannabis is, in part, considered an important piece in the national effort to combat the opioid crisis,” the statement continues. “Medical cannabis is seen as an effective pain treatment option that is cheaper, less addictive than opioids, and often preferred to prescribe to patients over opioids. A patient and their doctor should have every option available to make the best decisions for their care; and, medical cannabis as an option growing in demand, health insurance plans—including worker’s comp and PIP—should cover its costs too.”

Although most states have accepted cannabis as a legitimate medicine, the disconnect between state and federal cannabis laws has discouraged most states from attempting to force insurers to cover medical pot costs. A1708 includes an amendment that lets insurers off the hook in case the federal government decides to interfere with New Jersey’s medical marijuana program, but insurance companies are still afraid of handling weed-related claims.

“The biggest concern that we have of course is that it puts insurers in a very difficult position by potentially forcing them to violate federal law,” said Alison Cooper, vice president for state affairs of the American Property Casualty Insurance Association, during an Assembly hearing, NJ.com reports. “We do believe that it would be better to hold off on this proposal until Congress resolves the conflicts between federal and state law.”

Some lawmakers are indeed working to resolve these conflicts, but their chances of success depend on next week’s election. The US House of Representatives will vote on the MORE Act, a bill to end the federal prohibition of cannabis, after the election. As it stands now, this bill has little chance of passing the Republican-dominated Senate, but ranking Democratic Senator Chuck Schumer has promised that he will prioritize the bill if the Democrats win control of the Senate in the election. Joe Biden and Kamala Harris have also promised to consider decriminalizing cannabis on a federal level if they are elected.