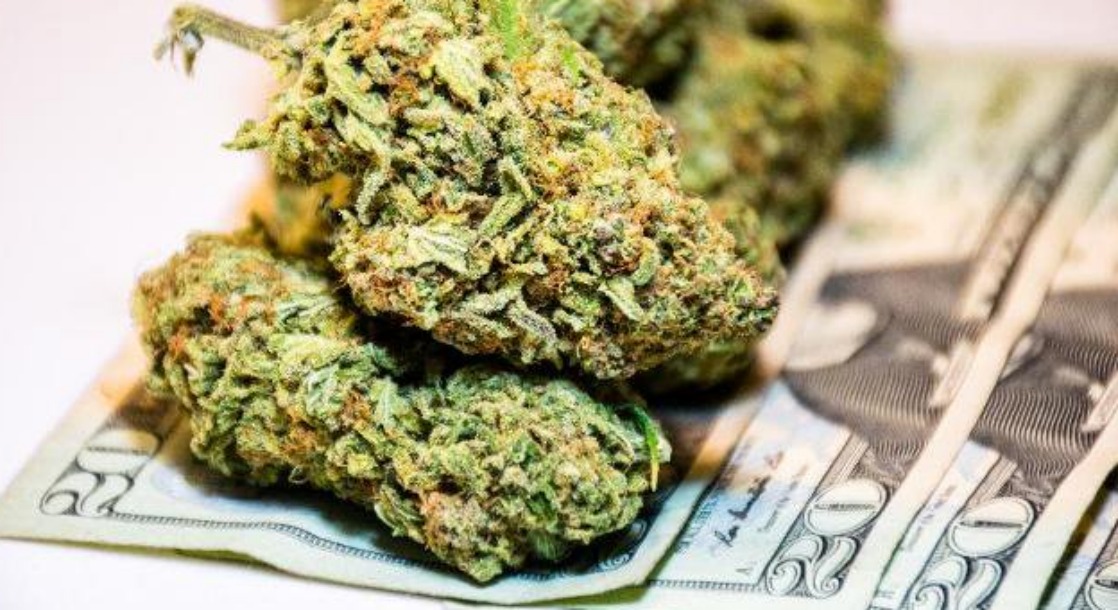

As states like Arizona and Michigan gear up for a push to legalize recreational cannabis in 2018, a new report from Oregon shows that things aren’t all peachy in the years directly following legalization.

According to an investigative report from Portland’s local NBC station KGW8, the over $75 million in tax revenue collected by the Oregon Department of Revenue has sat in a state-run account since recreational sales started in 2015.

Oregon’s recreational legalization law specified exactly where the cannabis tax money is supposed to go, with 40% heading to the state’s school fund, 20% going to fund drug and alcohol rehab and mental health support facilities, 15% to the Oregon State Police, 20% for local law enforcement on the city and county level, and the final 5% being sent to the Oregon Health Authority.

But so far, none of that money has made it out of the Department of Revenue to actually help the schools, hospitals, and cops.

Thanks to the language in the legalization law, before any tax money is disseminated, the state is required to pay back the Oregon Liquor Control Commission for the start-up costs they provided to get the legal weed industry off the ground.

Before recreational sales even began, the OLCC took out a $13 million loan to get the ball rolling., And according to the cannabis legislation, that loan must be paid in full before anyone of the other state agencies reap their due tax benefits.

Thankfully, Oregon’s schools and rehab programs won’t have to wait much longer. The state has more than enough cash to pay back the loan, and the law requires the state pay up before September.

Not all legal weed states are stuck in a revenue purgatory, though. Young adults in Pueblo, Colorado are already taking advantage of the state’s legal weed tax dollars with a free community college education.

Hopefully the states looking to legalize in 2018 can take notes from Colorado instead of Oregon and start using their expected tax dollars as soon as they start rolling in.