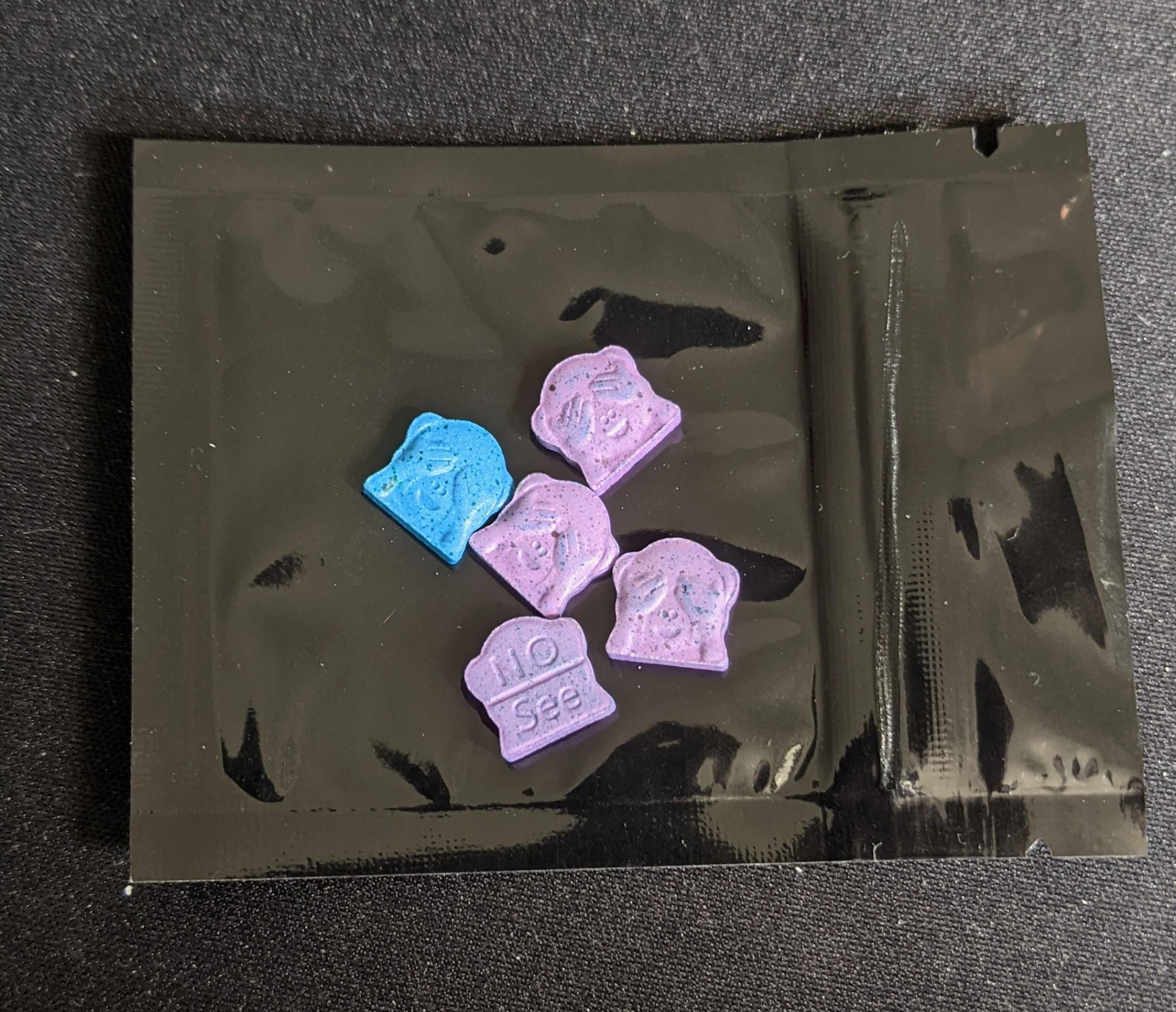

Michigan schools, localities, and transportation projects will be receiving almost $150 million in additional funding this spring, all thanks to legal weed.

Last year, Michigan’s thriving cannabis industry made a record $1.8 billion in combined adult-use and medical sales, bringing the state nearly $250 million in additional tax revenue. Around $115 million of this revenue went into the state’s general fund, and nearly $150 million was sent to an excise fund to be divided between schools, transportation, and individual cities and towns.

Last week, the state Treasury Department announced that it would be distributing $49.3 million of weed tax revenue to the state’s School Aid Fund for K-12 education. The department will also be dropping an equal amount of weed income into the state Transportation Fund, which will redistribute the cash to towns and cities that require road and infrastructure repairs.

Michigan towns and cities that have chosen to allow legal pot businesses on their home turf will also be receiving a healthy payout this year. Every municipality that opted-in to the legal weed industry will receive $56,450 for every single licensed cannabis retail store and micro business that operates within its jurisdiction. In total, the state will be handing out $42.2 million worth of tax revenue to 163 localities.

Counties, towns, and cities that authorized local weed businesses are collecting twice as much excise revenue this year as they did in 2021. Last year, the state only dispensed around $28,000 per licensed retailer or microbusiness. The total $42 million payout is actually four times higher than the $10 million sent out in 2020, though, because 59 additional localities opted in to the weed market in 2021.

“It’s rewarding to see that the agency’s balanced regulatory approach is effectively protecting consumers while still allowing Michigan businesses to grow and thrive,” said Andrew Brisbo, executive director of the Marijuana Regulatory Agency, to Marijuana Moment. “The funding provided directly to local governments—and the thousands of jobs created across the state—show that Michigan is leading the way in the cannabis industry.”

Cannabis tax revenue is helping adult-use states like Michigan fund critical social services at a time when the pandemic has cut deeply into state budgets. Several states, including Illinois and Massachusetts, now make more tax revenue from weed than they do from booze, and heavily taxed markets like California are drawing in close to a billion dollars in pot tax revenue every year. Since 2014, when Colorado and Washington began selling legal recreational pot, adult-use states have collected more than $10 billion in weed taxes.

Most states are using these taxes to help fund school, health, and transportation programs, but Alaska has also reinvested half of its pot taxes into reentry programs for inmates. Illinois has used its cannabis revenue to fund expungement and social justice projects, and some individual cities are also working to use this new stream of income to fund reparations or universal basic income programs.