Kanye West’s mental struggles and family drama are at the center of a new lawsuit brought by the entertainer against Lloyd’s of London, a UK-based insurance company that is reportedly refusing to pay money they owe the artist after he missed a series of concerts during the second leg of his “Saint Pablo Tour” last year.

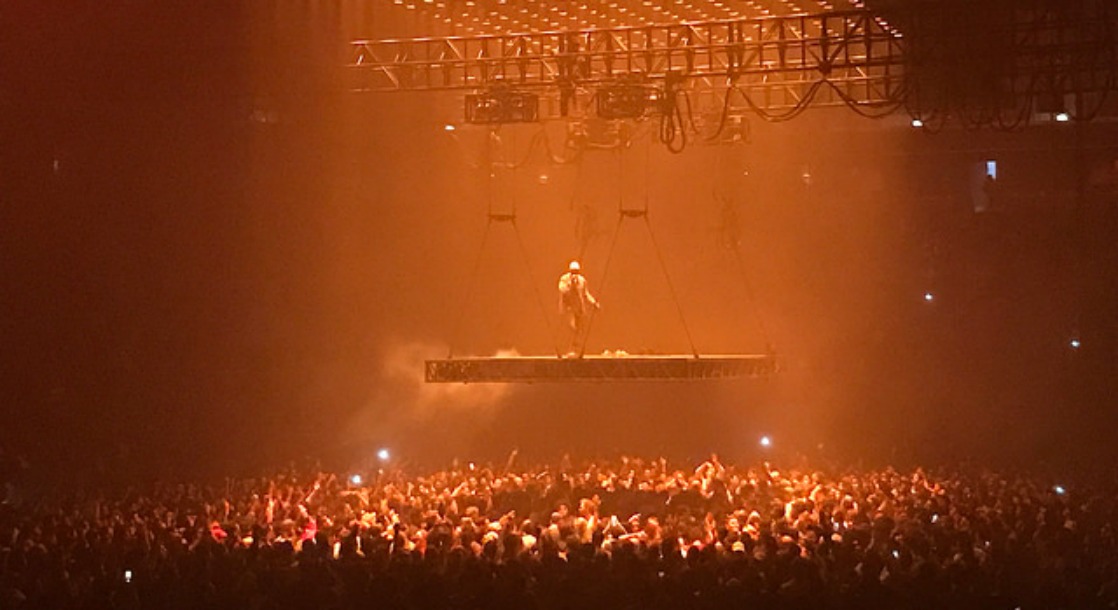

According to court documents obtained by the Hollywood Reporter, Kanye set up a policy with Lloyd’s before his critically acclaimed tour kicked off, paying a hefty fee to ensure that he would still be paid in the case that he had to miss any of the tour dates. After his wife, Kim Kardashian, was robbed at gunpoint in October, Kanye missed two shows, but returned for the second leg of the tour, only to cancel the remaining shows following erratic behavior and controversial rambling at a show in Sacramento, California.

West subsequently checked himself into the psychiatric ward of the hospital at UCLA, and took enough time to recover. However, according to Kanye, when he filed a claim with Lloyd’s to recoup the money from the missed shows, they instead put together a legal team with the aim of denying him coverage on the grounds that marijuana use was the contributing factor in the psychological distress that led to the cancellation of the tour dates.

"…Nor have they provided anything approaching a coherent explanation about why they have not paid, or any indication if they will ever pay or even make a coverage decision, implying that Kanye’s use of marijuana may provide them with a basis to deny the claim and retain the hundreds of thousands of dollars in insurance premiums paid by Very Good," Kanye’s lawyers wrote in a complaint filed this week in California federal court. "The stalling is emblematic of a broader modus operandi of the insurers of never-ending post-claim underwriting where the insurers hunt for some contrived excuse not to pay."

There has been no further explanation of the cannabis claims, but Kanye did undergo a series of independent medical examinations ordered by the insurer, and was given the same tour-ending diagnosis he received from his personal doctors, raising even more questions about the stalled payment.

"Almost immediately after the claim was submitted, Defendants selected legal counsel to oversee the adjustment of the claim, instead of the more normal approach of retaining a non-lawyer insurance adjuster," West's complaint reads. "Immediately turning to legal counsel made it clear that Defendants’ goal was to hunt for any ostensible excuse, no matter how fanciful, to deny coverage or to maneuver themselves into a position of trying to negotiate a discount on the loss payment."

To try and recoup the full amount due, and then some, West is suing Lloyd’s of London and a number of their subsidiaries for breach of contract and breach of good faith and fair dealing.